Should You Work Longer to Increase Social Security Payout?

I read an interesting blog post about a month ago that talked about the effect of early retirement on social security. The writer concluded that retiring early on a high income was essentially the same as working longer at a lower income. In essence, the total amount of income is more important than time in the system.

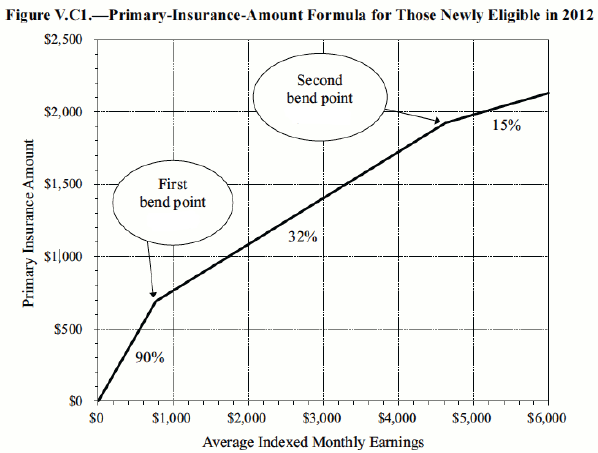

The reasoning behind this is how social security payments are calculated. The SSA, Social Security Administration, uses a formula to calculate ones benefit. That formula works off the PIA or primary insurance amount. The PIA formula uses a sliding scale and the average indexed monthly earnings (AIME).

Confused? Good. Then we were in the same boat the first time I read through this as well.

An example and charts will help explain the whole mess.

AIME

For starters we have the AIME, average indexed monthly earnings. Simply put, this number is how much you have earned in a 35 year period divided by 420 (35 years * 12 months). If you made a million dollars ($1,000,000) over the course of 35 years your AIME would be $2381 (they get rounded to the nearest whole dollar).

If you work more than 35 years, the lowest working year incomes are tossed out. If you work less than 35 years (early retirement) then the empty years are filled with zeros and that drags your AIME down.

Finally, in order to qualify for SS, you have to earn 40 work credits. You can earn up to 4 credits per year. To simplify, you have to earn money for at least 10 years to qualify for your own SS benefits (non-spousal).

You can look up your current work credits and earnings income on ssa.gov.

Now that we have an idea of what AIME is and what your AIME number could be, let’s see how the PIA formula plays out.

PIA

PIA works on a sliding scale. The first $856 of your AIME pays out at 90%. The amount of AIME between $856 and $5157 pays out at 32%. Anything above $5157 is paid out at a measly 15%. Graphically, it would look something like this:

Let’s consider two hypothetical men Mr. Management and Mr. Pleb. Management has done quite well for himself and his AIME is $6000 ($2.5 million earned over 35 years). Pleb has an AIME of $3000, half that of his middle management boss.

Using the PIA formula we can figure out the social security benefit for each man.

Mr. Management would get:

($856 * 0.9) = $770. This is before the first bend point

Plus

($4301 * 0.32) = $1373. This is between the two bend points

Plus

($843 * 0.15) = $126. This is after the final bend point

His total benefit would be $770 + $1373 + $126 = $2269/mo

You can see how the sliding scale makes the first $850 yield so much more than the last $840 dollars (770 vs 126). Social Security was designed to be a progressive system and is inverse of our progressive income tax system (the rich pay more and get less).

How about Mr. Pleb?

($856 * 0.9) + ($2144 * 0.32) = $1456/mo.

Mr Pleb made half as much as his boss, but will get more than half in social security.

How is this Useful?

Now that we know how the system works, we can game the system. It should be obvious that reaching the first bend point is critical to maximizing ones benefit. It should also be apparent that exceeding the second bend point is rather pointless in terms of benefit returns.

To fill up the first bend point, you’ll need to earn $359,520 over the course of 35 years (~$10k/year). It doesn’t matter if you earn 10k a year for 35 years or 360k in one year and nothing in other 34 years. Your SS benefit will be the same.

Social Security lacks returns once you cross over $2,165,940 of earned income (~$62k/year).

To game the system, try to earn as closely to 2.1 million as possible. Once you’ve made that, you can stop asking yourself if working longer is worth it for a bigger SS check. If you don’t make it to that amount, don’t sweat it. The really important bucket to fill is that first 90% payout.