Lifestyle Inflation

Investopedia.com defines lifestyle inflation as

Increasing your spending when your income goes up. Lifestyle inflation tends to continue each time someone gets a raise, making it perpetually difficult to get out of debt, save for retirement or meet other big-picture financial goals. Lifestyle inflation is what causes people to get stuck in the rat race of working just to pay the bills.

Not too long ago we were broke college students with hardly any income and student loan debt. The only places we could afford to live were dumps. Dumps with roommates to be more precise.

The first place that we lived outside of the college dormitories was a rented house with four other housemates. The rent was divided six ways for a five bedroom house (a love triangle of suicidal lesbians lived together in a very unpredictable fashion). The small arts and crafts bungalow was an improvement in many ways from the dorms in terms of both space, e.g. a full sized kitchen, and financially. We each paid $250/mo in rent and took a share in the $300-500/mo outrageous utility bill. Our housemates were very wasteful. Even so, it was a cheap place to live for the six months that I was there and the twelve that Shae resided.

Determined to keep my living expenses low and remain close to my sweetheart, I rented my first solo apartment a few blocks away until Shae could finish up her college degree.

This had to have been the worst place that I have ever lived. The single bedroom, garden level, apartment cost $300/mo plus utilities. Now that I was on my own, utilities were quite a bit cheaper as I could control the thermostat and the laundry was coin operated (aka not run constantly by housemates washing A pair of pants or A shirt).

I did not have cable, a landline, internet service, smart phone, or satellite tv. I walked to work and only drove to buy groceries. Shae and I only ate out when her parents visited. The lifestyle inflation was small if at all present. If homelessness was rock bottom, the months spent here were akin to resting on a pad of paper that sat on the rock.

That first apartment is the source of most of my horror stories. The entire place was infested with cockroaches and the landlord, a real scum ball, was too cheap to pay for an exterminator. On more than one occasion, I would wake up at night to feel one running across my bare torso. It took several years to undo that complex.

My bedroom had an “exterior” door that opened to the utility/laundry room communal area. It was not uncommon for other tenants to start laundry at 11pm.

The kitchen had cracks in the floor that seeped water when it rained (probably why the roaches loved the place so much). Yes, that is a typical lunch laid out on the stove (bologna, cheese, and mustard).

The living room had a window that was busted out and a piece of plywood had been wedged in. I plastic’d the window up in the winter time and it would bellow in and out as the wind whipped around outside.

As part of living on the ground floor in a locked building, strangers would often ring my doorbell or knock on my window to be let into the building. If I tried to ignore them, they would become belligerent and if I told them to ring the proper doorbell they would become belligerent. The police would often use me as the doorman whenever they came to check in on someone upstairs. I felt more inclined to helping them.

My office was only two blocks away and I would often walk out my backdoor and take the alley to get there. In the warmer months, a bum could often be spotted sleeping in the alley bushes in old army fatigues. Another example of the fine living establishments that I was enjoying was when the mailman joked to me that I was living in the terrorist apartment. It turned out it wasn’t a joke. The former tenant was a convicted terrorist and tried to blow up the state capitol building. I received a large box from a prison one day with random ratty possessions including some shower sandals, handwritten notes, and a grungy wife beater. I chucked it all in the dumpster.

So why in the world did I live in such a shitbox? Primarily for love, it kept me close to Shae, but also for money. The place was magnitudes cheaper than anywhere else that I could have rented.

Moving Up In the World

Shae eventually graduated and we hightailed it out of our respective housing situations to find greener pastures. Since my work could easily follow me around, we moved to a city that hosted employers looking for Shae’s talents and skill set. It was 2010 and the impact of the recession was still being felt by the cautious hiring of the time. Shae could not get into her dream job right away and had to start applying to 2nd and 3rd tier companies. As a result of being unemployed, landlords would not rent to her and she had to temporarily move back in with her folks.

With my still fledgling business and even smaller income I was able to rent a ‘nice’ two bedroom apartment. The neighborhood had several other rentals operated by the property management company, and when Shae secured a menial grunt job a couple of weeks later she was able to move into her own two bedroom apartment across the street.

I paid $525/mo plus electric and she paid $545 plus electric. Our apartments were close enough that we could share an internet connection with a powerful wireless router. Each of us rented out our second bedrooms to graduate students to cut our housing expenses to about $262.50 + 1/2 electric + 1/4 internet. The neighborhood provided plenty of characters with one that expanded our vocabulary and another that sat out all day in a lawn chair to break change for ‘friends’.

It didn’t take an overqualified Shae long to move on from her gruntling GED requirement job to an associates job. Along with the safer, non physical labor, job came a bump in pay. Uh oh, here comes the lifestyle inflation!

It’s true, as my business grew and Shae moved up the job ladder/pay scale we did experience lifestyle inflation. Those bologna, cheese, mustard lunches turned into turkey, cheese, lettuce, tomato, pickle, and mustard sandwiches. Dinners transformed from chicken to beef. Fruits and vegetables could be found in our pantries and going out to eat was not just when parents visited.

Triple Life Changes

For the next year, life continued on with both of us paying half rent and working our respective jobs. We even scrounged up enough spare money to take a cruise in the Bahamas.

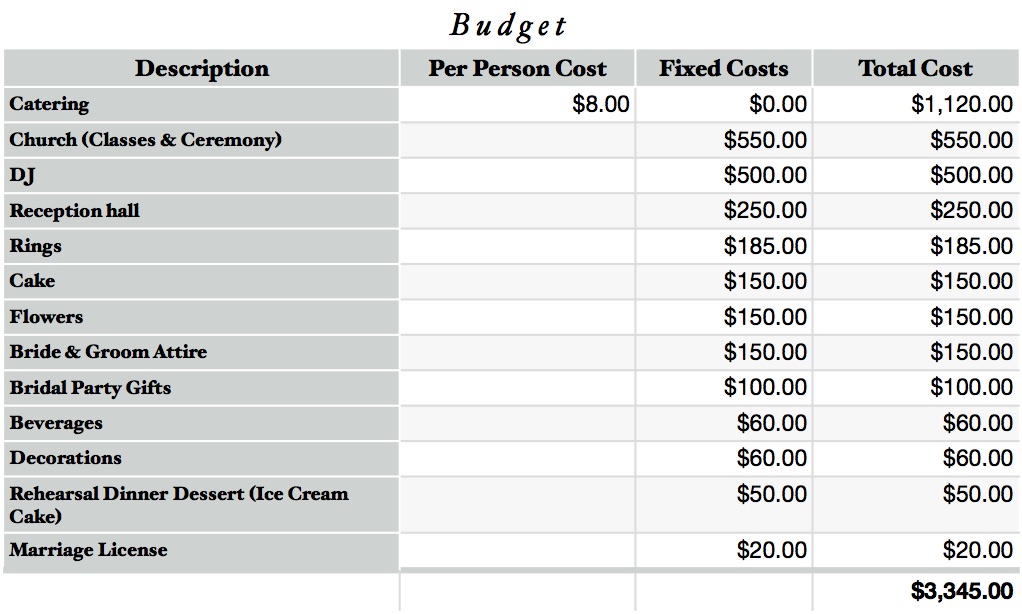

The summer of 2011 was a perfect storm for lifestyle changes. Shae started a new job with her target company, I landed a lucrative contracting job, and we got married. Without looking at the numbers I would guess that our combined income doubled.

We decided that I would move into her place as it was slightly nicer and had coin laundry in the building, working AC, and a dishwasher. Gone were the days of roommates and being able to split our internet bill four ways. As a newly married couple we *needed* some nice pots and pans, those plastic cups *had* to be replaced with glass, and pyrex containers replaced leftover lunch meat containers to pack lunch in. Too tired to make dinner that night, let’s just order take out. We bought his and hers smartphones on contract and shelled out over $100 a month because that’s what well earning married people do! Right?

Looking back at it and seeing the relatively minor bump in net worth in 2012, I cannot help but think of the song And the Money Kept Rolling In (And Out) in the hit musical Evita.

When the money keeps rolling out you don’t keep books

You can tell you’ve done well by the happy grateful looks

Accountants only slow things down, figures get in

the way

The song describes wealth redistribution and corruption in 1950s Argentina but I think it can also apply to poor personal finance.

Part of the problem was that we were busy house searching at the time and held almost all of our wealth in negligible interest rate savings and checking accounts. What money we did have saved up was not working for us. It was lazy money.

First Time Homebuyers

In 2013, after two years or searching, we found a house and moved.

Our cheap rent was replaced with a mortgage, property tax, homeowners insurance, repairs, all utilities, and furnishings. Mortgage + PTax + Utilities + insurance run about $850/mo. An increase of approximately 50% from our renting days, but with the advantage that the principal of our mortgage payments come back to us as equity in the house.

2013 we also started to get serious about retirement, investing, and trimming expenditures. All three helped us get ahead of the rat race that is lifestyle inflation.

Pay Yourself First

One of the best actions we took and I wish we started doing it earlier was diverting 25% of gross pay to tax advantaged retirement accounts. After 401k contributions, tax withholding, health insurance, and automatic taxable investments our take home pay was/is only about half our gross income. From there we skim off quadruple mortgage payments (paying ourselves in house equity). That leaves about 25% of our income to cover all other expenses (groceries, auto insurance, childcare, eating out, utilities, property taxes, entertainment, etc.).

Paying yourself first, especially with a % 401k contribution helps directly fight lifestyle inflation. If we get a raise a chunk of that raise never makes the paycheck. It is hard to miss something that isn’t there.

A Look Back

In 2012 our net worth increased 16%.

In 2013 it went up by 24%

2014 saw a whopping 41% gain (thanks in large part to the stock market)

While a 16% increase in 2012 isn’t bad, it could have been much more if we had been more cautious about lifestyle inflation. Mobile phone contracts alone wasted over $1200 that year. Leaving money sit around in 0.01% interest accounts also hindered growth. While it was likely the most prudent way to keep our down payment safe, you can see how the following years benefitted from aggressive investments and keeping a bare minimum in anemic checking accounts.

Should we go back to eating plain bologna, cheese, and mustard sandwiches or living in a roach infested apartment to save money? No. Lifestyle inflation per the definition is when your net worth (the green line) remains flat. As long as your net worth is trending upwards, you are beating lifestyle inflation. How much it is trending up is probably a good indication of how much LI is in your life. With that said, it is far easier to go up the lifestyle ladder than go down. Starting in the dump gave us plenty of room to grow.

Remember, a dollar saved is a dollar earned. The next time you get a raise, consider paying yourself first. Your future self will thank you.