Shae and I have kicked around the idea of buying investment real estate for several years. Today, we finally pulled the trigger. In all truthfulness, the moment came several months ago when we submitted a bid on an apartment building. It has just taken until today to finalize all of the legalese. Buying real estate isn’t for the faint of heart!

So what is so special about real estate as an investment tool. In one simple word, ‘leverage’. Putting someone else’s money to work for yourself is relatively easy in the world of real estate. Mortgages are advertised by virtually every bank, credit union, and even insurance salesmen! Right now, we are living in an almost unprecedented environment of cheap borrowing. The prime mortgage rate for a 30 year fixed rate loan is hovering around 3.5%. In fact, that is the rate we secured. I remember when I was a kid and you could have a savings account earn more than that.

With money so cheap to borrow and smart people expecting stock market returns going forward to range from 6-8%, it makes sense to seek diversification away from equities and bonds. One extremely popular and well established method of doing just that is owning investment properties.

We have talked together for years about what type of property we would want, why that would best achieve our goals, and how we would want to operate it. For us, residential housing, aka apartments, with a buy and hold strategy was a natural fit. Earlier this year, we got serious again about getting out of the armchair and into the field. We ran numbers on dozens of different properties for sale. I adapted a simple back-of-the-napkin model from BiggerPockets.com and used that to get a better idea of how different properties sized up to one another. Eventually, we started to get a feel for our local market. There were some abysmal numbers out there, a lot of mediocre ones, and some that seemed too good to be true. We started calling realtors and visiting places in person. Sometimes the numbers lined up with what we saw in person. For example, one place had an amazing rate of return on paper, but in person it was obvious that it was a high turnover, hard to collect rent type of place. When the tenants have smashed holes in the drywall, you run the other way as fast as your legs can carry you!

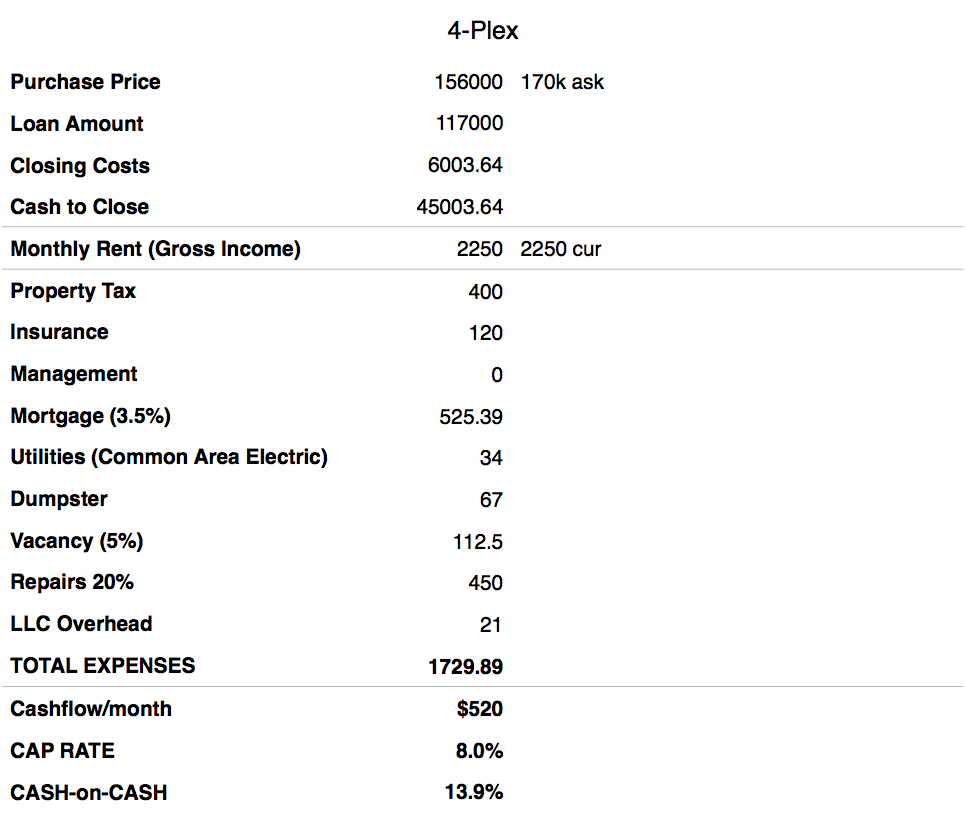

Eventually, we spotted an attractive looking quadplex that ticked off all our checkboxes. It had a simple geometry, was purpose built for apartments, good neighborhood, and was taken care of by a respectable owner. The ask price was 170k. We offered 151k. Other buyers put in bids, counteroffers ensued, and we eventually won with an offer of 156k. Below you can see our napkin investment math.

Monthly Rent through Total Expenses are on a monthly basis. The CAP RATE, or capitalization rate, would be the investments rate of return. Leverage is what makes the work worth it though. CASH-on-CASH is the rate of return that we are forecasting for the profit, cashflow/year divided by the cash to close. In essence, we made an investment of 45k dollars and expect to make 6k a year in profit. Of course, only time will tell how well it actually performs, but at some point you just have to jump in and start swimming. The other huge benefit of real estate is depreciation, but I’ll get into that closer to tax season.

2016 Year In Review – Frugal Living

[…] Our spending was heavily weighted by the down payment for an apartment building. […]

A New Landlords Look Back – 1 Year of Apartment Ownership – Frugal Living

[…] been one year (± a couple of weeks) since we became landlords. You can read the original post here. The goal a year ago and the goal today is to make money. So how did we […]