Freebie Website #3 – CreditKarma.com

I’m not sure where I first heard about CreditKarma, it was likely on a finance related forum somewhere on the inter webs. Anyhoo, I decided to check it out for myself and try out the service. That was over a year ago.

What is CreditKarma.com you ask? Taken from their own website,

Credit Karma offers a new way to track your credit score and a unique way to benefit from it. For the first time you can get a truly free credit score with no hidden costs or obligations. Based on your score, you gain access to exclusive offers from companies that value your creditworthiness.

The last line should make you feel more comfortable because now you know the catch for the free service. They are going to offer and promote credit cards and other financial products to you. That is how they make their money, not by selling off your identity to some bloke in a country you cannot pronounce.

Now that we have determined that this is a legitimate business, we can go ahead and create an account. Accounts are free, and I can confirm that over the past year they have never asked me for my credit card #. You will need to fill out some information online, including your SSN. Don’t worry, this won’t affect your credit score in any way. The site advertises that it will take less than 2 minutes to create your account and get your credit score.

At this point, you may be asking yourself, “I can already get 3 free credit reports a year from Experian, Transunion, & Equifax. Why do I need to signup for this website?” Yes, you can get credit reports, but credit reports aren’t credit scores. The most popularly used credit score system is the FICO and it ranges from 300 to 850. A score of 300 means that you are extremely risky to lend to and are unlikely to pay it back. A score of 850 is extremely rare and signifies an almost zero risk loan. Your FICO credit score is computed using a proprietary formula that analyzes your credit report. Late payments, bankruptcies, hard inquiries, high credit utilization, number of lines of credit, and average age of lines of credit are all included on your credit report and therefore figure into your credit score.

Credit Karma calculates your number using the Transunion New Account Score. The TNAS also ranges from 300-850 and is claimed to closely correlate to your FICO score. Below you can see my TNAS score.

Credit Karma would be kind of pointless if all it did was show you a score. Fortunately, it offers a wealth of additional information that can be used to improve your score, compare your credit to other demographics, analyze credit card offerings, and much more. Let’s take a look at some of those features.

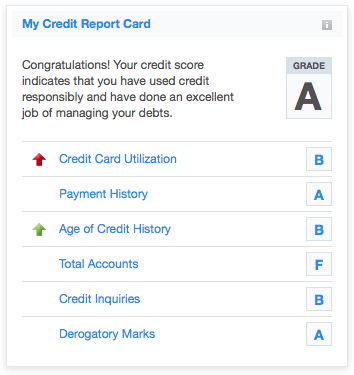

Credit Report Card

First up is the credit report card. You can see the summary of mine below.

The credit report card helps you improve your credit score by showing you where you are losing points. It also tells you the weighting of each category. For instance, Credit Card Utilization has a HIGH weighting and I currently have a B grade. That tells me, that I need to cut back on using my credit card in order to improve my score. On the other hand, Total Accounts has a low impact on your score. I currently have an F in that category because I do not have many lines of credit. It probably isn’t something that I need to rush out to fix though because it has such a low impact on the overall score.

If you click on any of the metrics you will get additional information about it like so.

They even offer a credit score simulator so you can see how opening a new credit card or paying off an existing balance would affect your score.

Demographic Comparisons

Do you want to see how you stack up to other people using Credit Karma? Not a problem! As part of the report card you can compare your numbers against the general user base. Below you can see how I compare to other Illinois residents aged 26-30 in making payments on time.

As you can see, 3 out of 10 peers have missed at least one payment. Ouch! Credit Karma offers some suggestions about how to avoid missing payments.

Reviews

The last noteworthy feature of Credit Karma doesn’t require an account. You can see score and demographic stats on different credit cards. For example, here is a link to the Chase Sapphire Preferred® Card review page. As you can see, the minimum credit score needed to obtain this card looks to be around 650.

A higher credit score will net you a higher limit (with exception to the very bottom, can someone explain to me what is going on there).

And the folks with high credit scores and high credit limits also tend to have the lowest balance.

There are a bunch of different card stats available online so you can look up your own card and see what kind of limits and scores are out there. (I don’t have a Chase Sapphire card, I just used it as an example).

Conclusion

Credit Karma offers a virtual (literally) treasure trove of information. You can use it to get an idea of what your current credit score is and then how to improve it. It is pathetically easy to compare your own situation to the anonymous masses and see how you stack up. Finally, if you are shopping for a new credit card it can help shed a little insight into the type of person a card is aimed at. I would recommend signing up for an account if for no other reason than to have a free “manual” credit monitoring service. Just log in once a month or once every other month and make sure no funny business has popped up on your credit report.

Oh, and make sure your password isn’t something stupid like 1234.

When was the last time you checked your credit report? Your credit score?