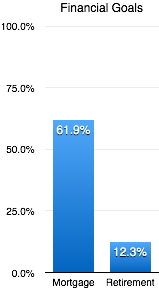

You may have noticed an addition to the sidebar. It is this little chart graphic that I try to update once a month.

It is our yard stick for two major financial goals in life. The first is to pay off our mortgage and be completely debt free. The second is to have enough interest earning assets socked away to be able to live indefinitely without having to work (aka retirement).

We currently have 62% of our mortgage paid off. Our extra payments help to chip away about 3% every month.

The retirement bar rises more slowly and could even decrease if the stock market goes down. We are currently at 12.3% of our retirement goal, but what is the goal number? More importantly, how do you find out your own goal number?

Planning for Retirement

There are only a couple of numbers that you need to know in order to plan for retirement. The most important number is your annual expenses. Ya, ya, I know what you are thinking. All of those retirement calculators and financial gurus on the internet talk about retirement in terms of income. “You need to be able to replace 80% of your working income in order to retire.” Let me tell you, that’s a load of crap.

What you really need, is to be able to cover 100% of your expenses. You track those, right? If not, now’s a great time to get started with Mint.

The great thing about basing your retirement goal off your expenses is that if you want to retire sooner, you just have to lower your expenses! Man, I knew this frugal thing was going to pay off. 🙂

Before you rush off to figure out your annual expenses keep in mind that they should be adjusted for retirement. If you are going to be mortgage free before you retire, you can drop those mortgage payments from your total. The same goes for items such as daycare, estimated income tax (you’ll be retired), and any debts that you have paid off (student loans, credit card, car, etc…).

Okay, so do you have your annual expenses number? Let’s use $30,000 as an example.

4% Rule

Here comes the second number. If you guessed 4 you’re wrong. The second number is 25. Multiple your annual expenses by 25.

$30,000 x 25 = $750,000

There you go, that is how much money you need to save in interest earning assets (like stocks and bonds) in order to retire. Do you see what I did there. I said “retire”, I didn’t say “retire at 67”. That’s right, once you have your nest egg you should be able to retire at any age and live indefinitely off your nest egg.

Suuuurre… say the skeptics.

Don’t believe me? Let’s start with exhibit A, the Trinity Study. The study, done by a group of professors in the 90s, and later updated with recent historical data, looked at rolling 30 year periods to see how stock portfolios (50/50 stocks to bonds) would have fared since as early as 1926. The authors concluded that given a withdrawal rate of 4% per year, the likelihood of a portfolio surviving for 30 years was 96%.

It’s at this point that you look over to your SO, if you’re single you can skip this step, and you find out who among you is the more cautious. The cautious partner will probably say that number is too small, and want to use a 3% withdrawal rate just to be safe. So we really have two retirement numbers, the 4% and the ‘rock solid’.

If you’d like to read more about the Trinity Study and the 4% rule, Go Curry Cracker has a great write up on the topic.

Going back to our example, 4% of $750,000 is $30,000. Yay, the math works!

But $750,000 is SOO much money. Who could ever save up that amount of dough.

If you are close to the ‘normal’ retirement age, you may not have to. Social Security and any pensions may be able to subsidize your annual expenses. Instead of needing 30,000 from your portfolio a year, you may only need $10,000. That shaves off a cool half million right there. If you are still young and want to pursue early retirement then Social Security and pensions are too far away to be much of a serious help. Instead you’ll have to focus on two things, cutting expenses and raising income.

Early Retirement

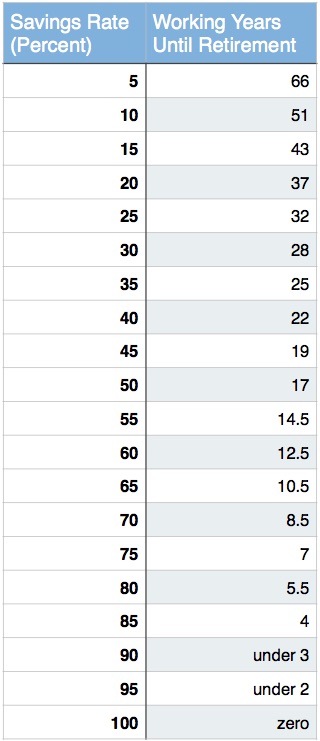

Mr Money Moustache (MMM), an avid early retirement blogger, has put together a simple table to correlate savings rate to years till retirement.

Saving 10-15% of your income for retirement will put you on track for retiring in your 60s or 70s, assuming you start in your early 20s. We are currently putting aside 25% of our income, and even that amount of savings only puts us on track for late 50s. Our goal is to increase our savings percent to 40 or 50 so we can retire early. Preferably before we turn 40. That may be possible if we are disciplined enough to pay off our mortgage early and save that freed up cash flow instead of spending it on lifestyle creep.

Some Final Thoughts

I use the word retirement, but what we are actually pursuing is early partial retirement. The flexibility of working when, where, and on what we want is incredibly appealing. It may not be necessary to reach 100% of our retirement number if we offset our annual expenses with partial working income.

The second thought, is that no where in here have I mentioned financial windfalls. That could include winning a lottery, or receiving an inheritance. The reason for their omission is simple, you shouldn’t count on them or rely on them.

Finally, the 4% rule has been getting a lot of flak in the past few years saying it is obsolete and no longer valid. The arguments generally go that bond rates have plummeted in recent history and yield close to zero. The 2008 crash and subsequent depression hit close to home and rattled a lot of 401k holders. The 4% rule works if you remain flexible. Should you buy a new car the year that the stock market drops 50%? Probably not, maybe you can make do with what you have until your portfolio recovers in a year or two. Is the market up 15% this year? Maybe you should withdraw more than 4% to build up cash reserves for down years.