529 College Savings Plans Get Supercharged in 2018

One of the most significant tax changes enacted recently and also one that received very little media attention was the turbo charging of 529 College Savings Accounts.

If you weren’t using one before, you definitely need to start now if you have kids!

In the Olden Days

529 plans allowed parents, grandparents, uncles, aunts, etc… to invest money in stocks, bonds, or money markets and then pull that money out to pay for college expenses without paying taxes on the investment gains. If that weren’t sweet enough of a deal, most states won’t charge their income tax rate on any contributions. Essentially, you win on both the front end and back end. You get a tax break on the state level by putting money in and shielding it from state taxation AND you get a win on the backside by pulling money out and not getting a tax bill from Uncle Federal Sam on the 100-300% appreciation that you’ve likely made ($100 invested for 18 years compounded @ 6% yearly growth would be worth $285.43).

2018 Onward

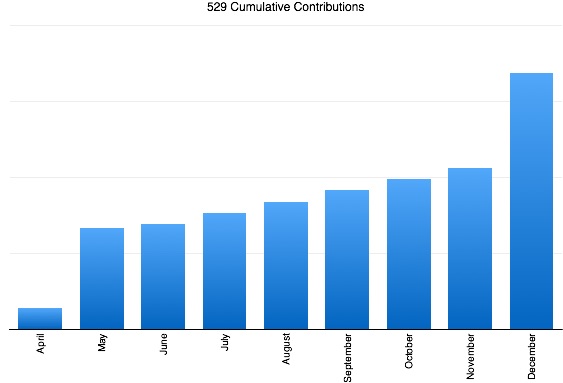

Now, you can pull the money out of a 529 to pay for K-12 private school tuition. This is YUUGEE. As an example, let’s consider a family of four living in the great state of Illinois.

Illinois income tax rate is a flat 4.95%. For this hypothetical, let’s pretend that private school tuition is $6,500 year per pupil. That would be 2 kids x 13 x $6,500 = $169,000 in tuition payments.

But if the parents were savvy, they would use a 529 plan to shield money from state taxes. They could be risk averse and simply choose a stable money market fund that won’t sway with the broader stock market, in which case they’d simply contribute money every year and withdraw it as needed to save 4.95% on tuition. $8,365 saved!

Obviously, the higher the state’s income tax the more beneficial this becomes. There is a cap of $10,000 a year of withdrawals for K-12 expenses so it cannot be over abused.

It would probably be a good idea to open two 529 accounts per child. One for K-12 expenses and another for post secondary education expenses.

More Reading… http://www.savingforcollege.com/articles/coming-soon-big-changes-to-529-plans