An Interesting Observation from Survey Data

This blog is about being frugal, and one of the advantages of being frugal is that you might be able to retire earlier or retire on less than the ‘norm’.

One of the internet forums that I peruse on occasion is reddit.com/r/financialindependence the community is full of individuals and couples that are looking to retire securely and possibly even decades earlier than the conventional 65-67.

This summer, there was an open survey on that forum, that asked participants a variety of questions concerning their personal finances. Just recently, the results of that survey have been posted. With over 1300 responses, there are some interesting conclusions that can be drawn, but I just want to focus on one.

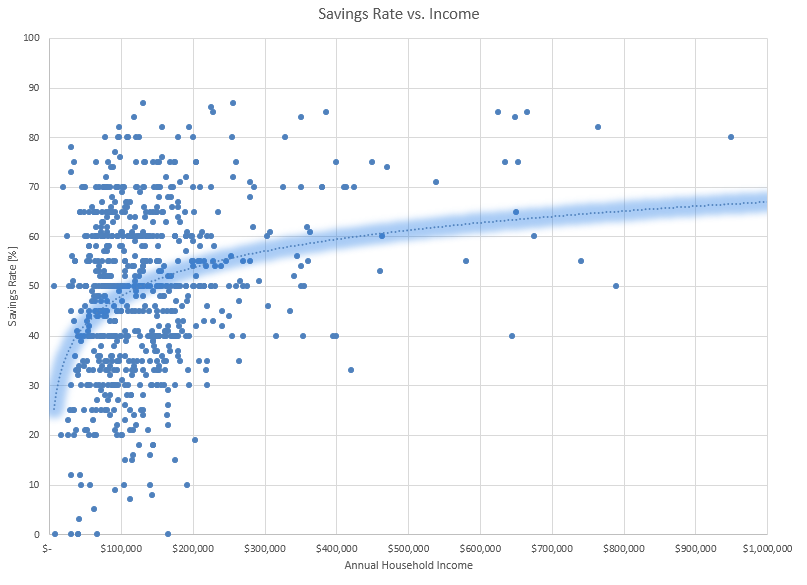

Savings Rate vs Income

We all know what income is, for example if you earn $40k/yr and your spouse earns $20k/yr and you have no other sources of income then your gross income number would be 40k + 20k = $60k/yr. Savings rate, is the percentage of that gross income that is left over after all of your yearly expenses, taxes, healthcare, etc are deducted from your gross income. In the above example, if you have $10k left over at the end of the year then your savings rate would be 16.6%. As a reference, Vanguard recommends that households put away 12-15% of their gross income away for retirement each year.

The forum members on financialindependence are not representative of the general population. Most of them are SINKs or DINKs (Single Income No Kids or Double Income No Kids) living in HCOL (high cost of living) areas such as the East or West coast cities. Usually, they have very high incomes that are multiples of the median US household income, $52k/yr.

With all of that said, you would think that the higher the income became, the higher the savings rate would be. After all, if you made one million dollars a year, surely you could stash away 90% of that. Couldn’t you?

It turns out, the data says something different. While savings rate does trend upwards, it is a very, very weak pattern.

Households making $100k/yr, nearly double that of the median household income in the US, are stashing away about 50% of that (keep in mind these are for people pursuing early retirement). Now look at the households making twice that, $200k/yr. The savings rate is still around 55%, a mere 5% increase despite a 100% increase in income.

What Gives?

There could be any number of reasons.

- Higher income households may have more student loan debt (doctors, lawyers, etc)

- Higher income households have a higher tax burden (28%+)

- Higher income households could be located in higher cost of living areas (NYC, San Francisco, D.C.)

- There could be a psychological barrier (I earned it, I deserve something nice)

I am not sure what exactly is going on behind the numbers, but I find it fascinating regardless.

What About the 1 Percenters?

If you widen out the chart to include truly preposterous incomes you’ll see two things happen.

- There aren’t as many data points, so it becomes harder to identify trends

- The existing trend doesn’t change much

Why Should I Care?

That’s a good question, and it has a simple answer. The time until you can retire doesn’t depend at all upon your income, it depends on your savings rate. The greater percentage of your income that you can save for retirement each year, the earlier you can retire. A popular early retirement blog explains the idea. For example, saving Vanguard’s recommended 15% of income each year equates to 43 working years. Saving 50% equates to 17 working years.

The question isn’t, “how can I earn more so I can retire faster” but instead, “how can I reduce my expenses and be more frugal so I can retire sooner?”

You can see some more of the survey results represented in purdy pictures here.