How do you manage your budget, keep track of cash flow, and plan for future financial goals? We use Mint.

Mint is an online aggregator of all of your financial accounts. The website and accompanying apps are run by Intuit, the folks behind Turbo Tax. As with all free services and products it is important to ask a basic question. “Am I buying a product or am I the product?” The way Mint makes its money and can afford to offer the service for free is by showing you ads for financial products and services it thinks you would benefit from. So in this case you are the product.

With that said, we have been using Mint for over five years and have found it is worth far more than the minor annoyance of targeted ads. Once you have signed up and linked some accounts you will see a screen that looks something like this:

Scrolling down a bit more reveals more information.

There is a bit more budget items and some additional histograms showing net income farther down the page but you get the general idea. It looks like we went over our grocery budget this month. Oops!

If you haven’t guessed by now, we are a joint finance household. When we got married we ditched individual finances and threw everything into one big pot. Mint makes that even easier because even though we went from two Mint accounts down to one, all of the transactions and history popped up in the super mega account once the bank/investment/loan/etc details were entered in.

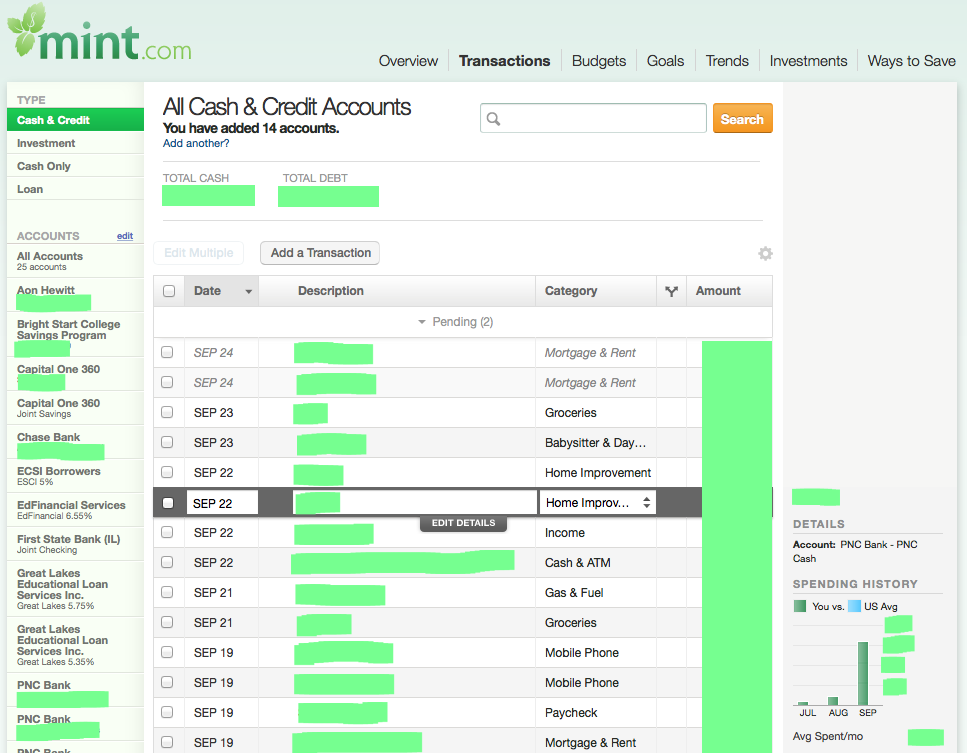

Speaking of transactions, here is what the Transactions page looks like on Mint.

We can account for every penny earned and spent for as long as we have been using Mint. Pretty neat eh? There are some cool things that you can do with that information that I will talk about later.

The next page is the Budgets. You can create as many weekly, bi-monthly, monthly, etc line items that you want. If you aren’t budgeting, shame on you. A budget is often thought of as restrictive but in reality it can help you ‘pay yourself first’. We have many of the standard budget items, but because we know where every dollar is going we also know how much is left over each month. Some of our budget items are for fun things (aka not bills) and by saying we have X dollars to spend a month on hobby A or B makes it much more enjoyable. Oh geez, I ‘have’ to spend money on my hobby. 🙂

Mint’s budgeting is far from perfect, especially for irregular items such as Auto Insurance. It takes a bit of finagling to get it to look right and at some point you decide just to live with the occasional red bar of overspending dishonor.

Going along with budgets, you can also setup Goals. These can be long term goals like retirement, or short term ones like paying off a loan.

The last page that I’m going to talk about is the Trends page. I don’t think that Mint offers much insight into Investments so I’m going to skip that weak page.

The last page that I’m going to talk about is the Trends page. I don’t think that Mint offers much insight into Investments so I’m going to skip that weak page.

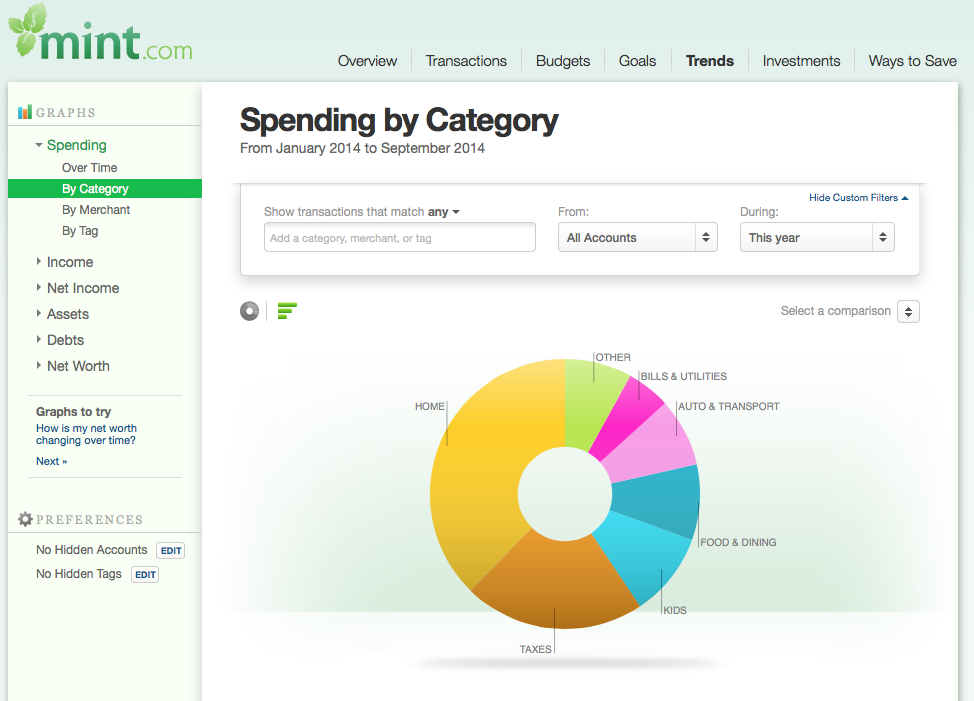

Remember when I said you could track every penny spent. Well, you can also visualize all of that data. For example, here is a pie chart of all of our spending for the year to date.

“Home” would be mortgage payments, improvements, etc. Taxes would include federal and state income taxes as well as estimated tax payments made for my business. It also includes property taxes. You can see that Frugal Boy has carved out a nice wedge for himself this year. That wedge will likely grow larger over the next 18 years.

“Home” would be mortgage payments, improvements, etc. Taxes would include federal and state income taxes as well as estimated tax payments made for my business. It also includes property taxes. You can see that Frugal Boy has carved out a nice wedge for himself this year. That wedge will likely grow larger over the next 18 years.

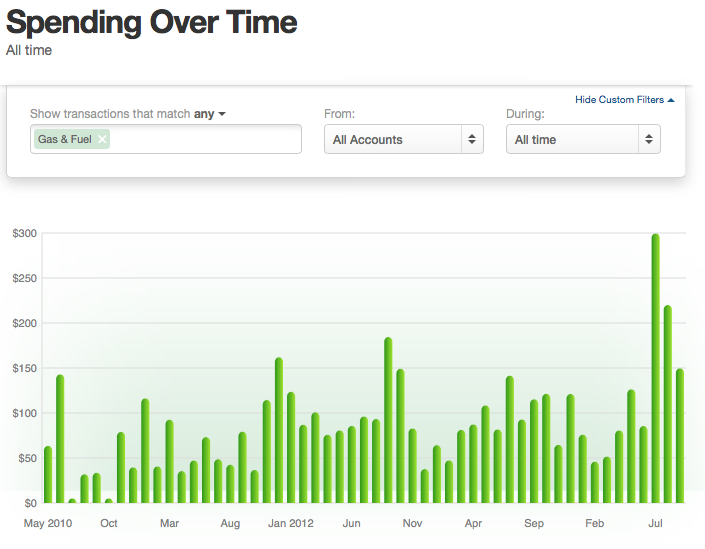

How about spending for “all time” (aka as far back as the financial data goes, ~4-5 years).

You might be surprised at how much you’ve spent (and earned) over the years. For example, I was a bit dismayed to learn that we have spent $4,759 on Gas & Fuel since May of 2010. I guess the daily commutes and road trips add up over time.

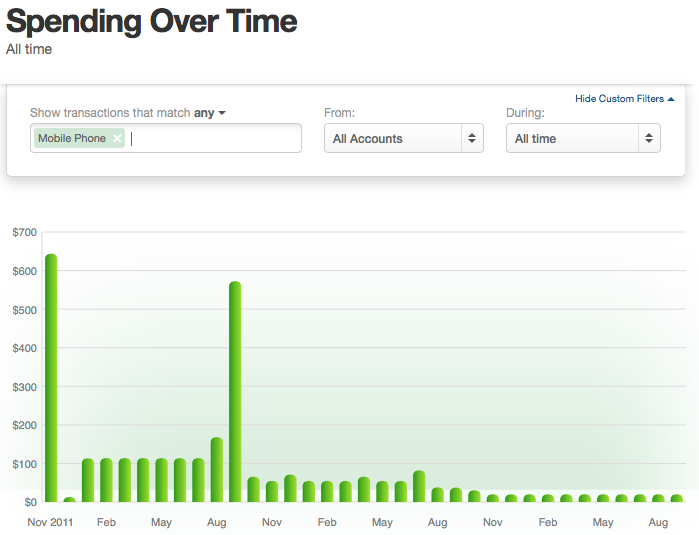

The “Mobile Phone” category spending over time is a good example of how a monthly expense can be reduced.

The “Mobile Phone” category spending over time is a good example of how a monthly expense can be reduced.

We’ve spent a total of $3100 on cell phones since November of 2011. You can see the first spike where we bought the phones. Then we piddled money for 8 months on a post pay contract (what the majority of Americans do). In September of 2012 there is another spike where we paid the ETF, early termination fee, to get out of the contract. Then we spent approximately 10 months with GoPhone, a prepay no contract. Finally we wised up even more and reduced our cell phone bills even further by switching to Airvoice Wireless. I have to say that I really like the trend shown on this chart!

For you techno savvy individuals, Mint also makes mobile apps and even a Mac desktop app that sits in your menubar. I like to check it once a day just to keep an eye out for any fraudulent activity.

Conclusion

I would highly recommend Mint to anyone wanting to get a better grip on their finances. We have around 25 different accounts linked to Mint (a good chunk of those are paid and closed student loans!). Still, I couldn’t imagine logging into each individual account on even a weekly basis to keep abreast of what is going on. The need to balance the checkbook is gone with Mint. It is a far superior ledger. The ads are pretty ignorable because they are all curated and formatted by the Mint team so you won’t be seeing crazy animated flash banners. Even the bombardment of Turbo Tax ads in the Spring is negligible.

Go sign up, it’s free!