You probably know who Warren Buffet is, but do you know about John Bogle? If you invest through Vanguard then you should, because John Bogle was the pioneer of low cost index funds. In his book, John Bogle on Investing: The First 50 Years, he presents a collection of essays and speeches that discuss the founding principles of Vanguard and why those principles are just as important today as they were 50 years ago.

Simplicity

Bogle argues again and again that simplicity is favorable over complex investing strategies time and time again. The more complicated you make investing, the harder it is to understand and the easier it is to get caught up and make a mistake. Why go to the trouble of sorting through a haystack to find a needle when you can just buy the entire haystack. In his opinion, instead of trying to pick winners (needles) out of the stock market, just buy the entire stock market (the haystack). The simple goal of enjoying the entire market return in aggregate will statistically beat the complicated goal of trying to outperform the market by identifying the best stocks.

Long Term Investing

The longer the time horizon is for the investment, the better it will do. While stocks are more volatile than bonds, over a 25 year horizon that increased volatility drops to a standard deviation of just 2% of a 6.7% median return (meaning that you could expect returns between 4.7% and 8.7% with a degree of confidence). Compare that to the one year deviation of 18.1% on 7% median return (-11.1% to 25.1%) and you can see how the longer you hold an equity the more the peaks and valleys are smoothed out. Just like Buffet, Bogle takes a buy and hold mentality.

Costs Matter

Vanguard is unique among brokerages because it is a mutual company. When you buy a Vanguard fund, you become a part owner of the company. The advantage of this over a private company, is that Vanguard wants to better serve its masters, and those masters are fund holders. What do fund holders want, lower costs!

Consider the two scenarios below. One portfolio has a 1.2% expense ratio, the second has a 0.2% expense ratio.

Now which expense ratio would you rather have? Cost is one parameter that investors can control!

Index vs Actively Managed Funds

An actively managed fund has a human being or a whole team of humans that are trying to pick winners for a fund. They eat, sleep, and breath financial markets. Why try and choose winners yourself when you can let a team of experts do it for you? The answer is that you shouldn’t let the ‘experts’ do it for you because historically they have been outperformed time and time again by index funds. Index funds are passively organized to track a benchmark. A common example would be an index fund that recreates the S&P 500. Index funds can pass cost savings, by not having to pay a salary to an expert, to you, the person who is risking their hard earned money.

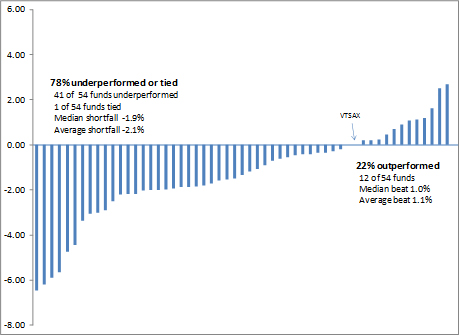

Bogle loves to tear apart actively managed funds in his book by showing cold hard numbers again and again. The numbers don’t lie, actively managed funds underperform. Just take a look at this analysis done by Forbes.

Using VTSAX, Vanguard Total Stock Market Index Fund, as the baseline, they compared 54 actively managed funds that had the same investment objective. 78% of those actively managed funds posted returns less than the passive index fund. Only 22% outperformed VTSAX. If I approached you and said you had a one in five chance of beating the market, would you bet the farm on it? If so, please don’t go to Vegas, they’d love you.

Conclusion

The book is quite long and not for the new investor. If you are interested in getting started in investing (you should be!) then I would recommend that you check out Vanguard’s 4 Principles for Investing Success on their website. Then use Vanguard’s Portfolio builder to get a recommendation that is personalized to your situation.

We will be reorganizing our taxable investment account in January to better align with Bogle’s and by extension Vanguard’s philosophies. For starters, we will be simplifying our positions from:

- VCR – Vanguard Consumer Discretionary ETF (expense ratio 0.14%)

- VDC – Vanguard Consumer Staples ETF (expense ratio 0.14%)

- VWO – Vanguard FTSE Emerging Markets ETF (expense ratio 0.15%)

- VYM – Vanguard High Dividend Yield ETF (expense ratio 0.10%)

- VCSH – Vanguard Short Term Corp Bond ETF (expense ratio 0.12%)

- VBK – Vanguard Small Cap Growth ETF (expense ratio 0.09%)

- AAPL

To:

- VTSAX – Vanguard Total Stock Market Index Fund Admiral Shares (expense ratio 0.05%)

By switching from ETFs to a mutual fund, we are simplifying our contributions. In the future we will be able to setup a monthly direct deposit directly into VTSAX instead of transferring money into our account and manually placing buy orders for each ETF.

We will also be reducing our cost. 0.05% expense ratio is an incredible value!

You may be wondering about diversification. Well, VTSAX, with 3804 holdings, gives us ownership in virtually every publicly traded company in America. We’re buying the haystack. Our prepayments on our mortgage serve as our ‘bond’ replacement, and I am not convinced that in our investment horizon (20+ years), foreign equity or bonds are needed at this time.

So there you have it. Our low cost, indexed, long term, and easy to understand investment portfolio. It consists of buying and holding a single mutual fund. What could be easier than that?