A while back my Mom visited and handed me an envelope full of savings bonds that I had left sitting in my parents safety deposit box. I didn’t know much about the bonds other than most had been birthday and Christmas gifts when I was a kid and that they were all still earning interest.

Today, I finally got online to do a little homework and see whether it was better to redeem them now or hold on to them and keep earning interest. If you have savings bonds tucked away somewhere you can look them up online and see all of the relevant information about them on TreasuryDirect.gov.

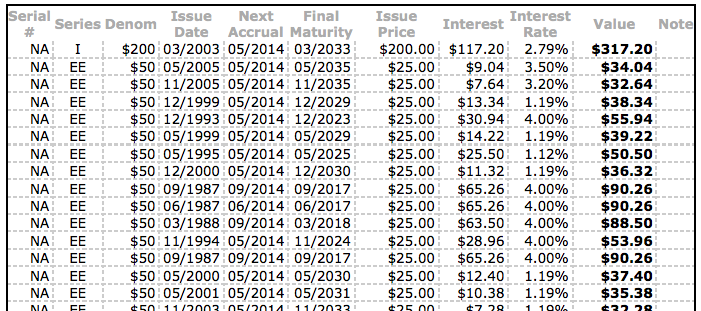

I was particularly interested in “Interest Rate”. As you can see, some of the bonds are still earning an excellent 4% return. That is a safe, guaranteed 4%. You’d have a hard time beating that kind of risk/reward anywhere else right now. Some of the bonds however were earning around 1%. While 1% is much better than the average savings account or CD today, I know I can put that money to better use.

I was particularly interested in “Interest Rate”. As you can see, some of the bonds are still earning an excellent 4% return. That is a safe, guaranteed 4%. You’d have a hard time beating that kind of risk/reward anywhere else right now. Some of the bonds however were earning around 1%. While 1% is much better than the average savings account or CD today, I know I can put that money to better use.

So where can you find a safer, higher interest rate? Try your home mortgage. By redeeming all of the bonds that are earning a lower interest rate than our mortgage, and putting that money towards our mortgage in the form of an extra lump sum payment, we can save more money in the long run than if we let the bonds reach maturity date.

By my back of the envelope calculations, we shaved off 4-6 months of payments from our mortgage.

There are a couple of other advantages to doing something like this.

- The risk of losing the paper bond is gone

- Paying down debt is a mental reward

- You are trading one long term investment for another (helps to keep your liquid, semi-liquid, solid percentages stable)

Yes, I know that Savings Bonds are more liquid than real estate, but given the nature that most savings bonds have a maturity date of 30 years and the most common mortgage is also 30 years, I found it to be an apt comparison.

A big thank you to all of my relatives (you know who you are) that gifted savings bonds to me all of those years ago. Kids don’t get the most excited about that kind of gift, but it is an excellent gift that they will appreciate more later on in life.